A few clients have asked us how to spot and avoid ESG greenwashing. They’ve asked how we ensure the “proof is in the pudding” when we construct Environmental, Social, and Governance (ESG) focused portfolios.

Greenwashing is an unfortunate trend, where investment products are marketed as more aligned with ESG factors than they are when examining the companies inside the products. BNY Mellon, Goldman Sachs, and DWS Group are some of the global financial institutions targeted by regulatory authorities for greenwashing.

Many investment firms rely on ESG scores or ratings from firms like MSCI and Morningstar, which rate companies and investment tools like mutual funds on ESG factors. However, even some of these ratings schemes have come under fire recently. MSCI has been scrutinized for including certain Russian energy companies in their ESG indices. Morningstar recently had to reclassify over 1,200 funds that were previously labeled as sustainable (amounting to $1M in assets).

Avoiding greenwashing through transparency

Large investment managers and third-party ratings agencies have been forced to re-examine their ESG measurement and alignment and how they deliver offerings in a transparent, measurable way to their clients.

I recently attended a leadership council for U.S. investment professionals focused on ESG investing. Greenwashing was the most talked about topic. Some key takeaways give insight into how the ESG landscape is shifting and how we’re responding:

- Many wealth managers think the objectives of “being aligned with ESG” and “achieving my financial objectives” are achievable together but require flexibility. For instance, there aren’t ESG-aligned investments in every diverse investment type or asset class.

- ESG-focused wealth managers believe that ESG alignment is a good way to manage investment risks (investing in the stocks and bonds of companies with good business practices).

- Regulators and clients are asking investment firms for transparency on how their investment offering aligns with ESG. Where regulators might have once asked a mutual fund manager, “Are you ESG?,” they now follow an extensive due diligence process.

- Aligning investment portfolios with client values allows wealth managers to deepen relationships with clients.

- Though there is no perfect measurement, it is important for wealth managers to be able to explain how ESG aligned a portfolio is.

- A good starting place is a reporting system that allows wealth mangers (and clients) to x-ray their portfolios and see what sorts of business and ESG objectives they are supporting.

Measurement tools

As part of our research process, we interview the managers of various investment tools. In addition, we now have an ESG measurement tool to look at our ESG portfolios more holistically.

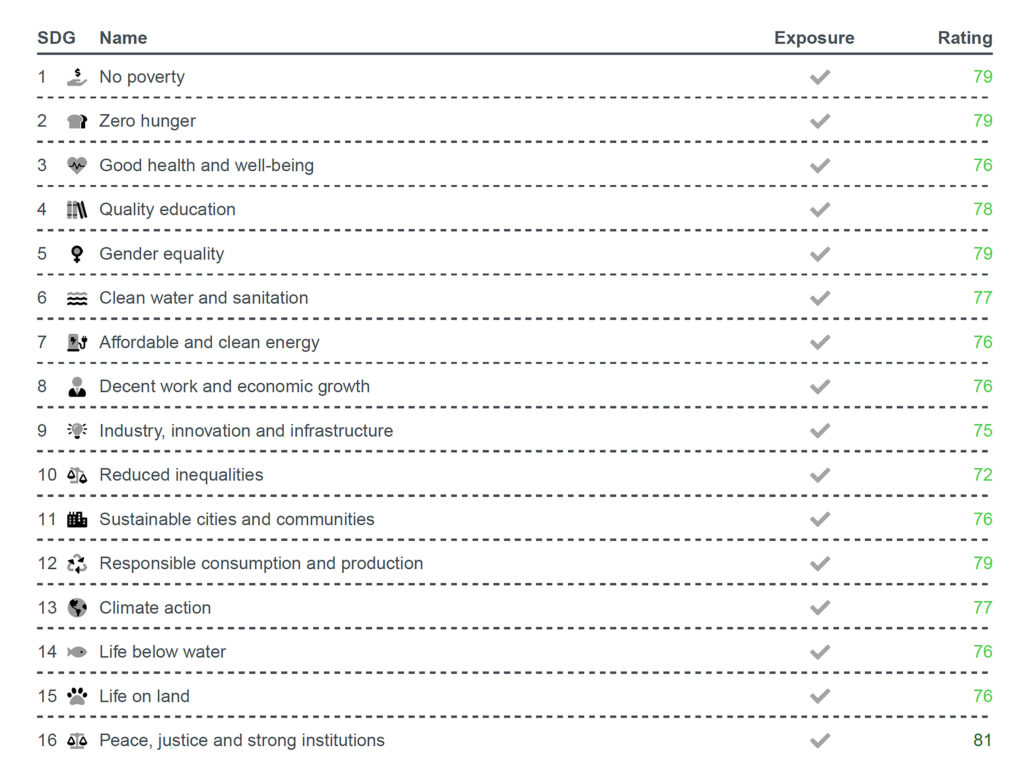

The tool, from Ethos ESG, allows us to x-ray our portfolios to better gauge the ESG impact of investment decisions. It helps answer how our ESG portfolios align as a whole with the United Nations’ sustainable development goals. These goals (such as gender equality, clean energy, reduced inequality, and climate action) have been broadly adopted by investment managers and development organizations as a polestar for aligning their impact objectives.

Here’s an example Ethos ESG report showing how an ESG portfolio measures in terms of sustainable development goal alignment. We don’t have a 100% alignment with the sustainable development goals because our portfolio is diversified in non-ESG areas like alternatives, cash-like investments, or treasuries. Also, no measurement tool will holistically capture every factor in a single score.

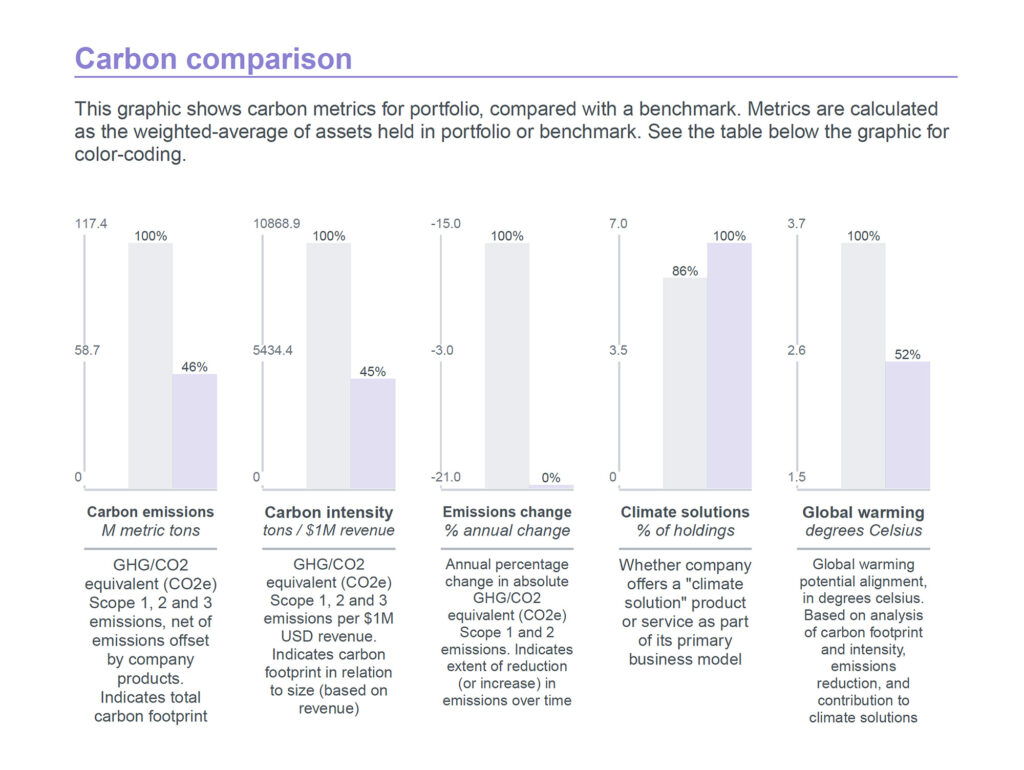

We’re also able to measure the carbon intensity of our total portfolio holdings. Measuring emissions impact is a broad measure of how our portfolio approach is doing in terms of climate action. Here’s the same example portfolio compared with a broad, non-ESG-driven portfolio with the same stock/bond mix.

We’ve found that no ESG measurement tool is perfect. For instance, we use several funds focused on bonds with targeted uses of proceeds, like a community development bond that targets an affordable housing project. Many ESG measurement tools don’t capture the impact of such Green Bond Funds.

Leaving bonds out of the picture can understate the overall impact profile of an ESG portfolio. Investments in private infrastructure and real estate like a solar farm or affordable housing project wouldn’t be reflected in our measurements, either.

Analyzing our ESG plus portfolios

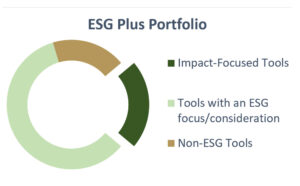

- Investment tools that focus on or consider ESG

- Investment tools focused on a specific impact theme, like community development lending or net zero transition

- Investment tools that aren’t ESG focused (because not all diverse investment types or asset classes are available with an ESG focus)

We’ve found that a 60% stocks / 40% bonds ESG portfolio has about half as much climate impact as a 60/40 non-ESG portfolio.

We’ve also found that our ESG portfolios are well-aligned with the U.N. sustainable development goals. We’re especially happy with our alignment considering that only 70-75% of the investments in our ESG plus portfolios have an explicit ESG focus.

Ethos ESG also enables us to compare the real-world impact of $1M invested into our ESG plus portfolios vs. $1M invested in a benchmark 60/40 portfolio:

Through transparency, diligence, and portfolio scoring, we’re able to show the “proof is the pudding” to avoid ESG greenwashing in our ESG investment offering. This also helps us determine the “puts and takes” from an ESG perspective as we adjust portfolios to market conditions.

I want to thank the clients whose questions and suggestions encourage us to keep evolving our ESG offering.

Laura, the founder of LWP, is a Senior Wealth Manager, Chief Investment Officer and Shareholder. She has a master’s degree in tax and is an excellent listener. While she is a sophisticated financial planner with experience in complex issues, her priority is ensuring a financial plan works for people.