About 60% of our clients approach their investments with an eye toward the impact their money has on society and/or the planet.

This style of investing has rapidly become one of the most important themes in the financial world. As of last year, about $35.3 trillion in assets globally are in values-based investments, according to the Global Sustainable Investment Alliance. That’s over one third of all assets in five of the world’s biggest markets.

I want to answer some common questions we get from clients and explain how we approach values-based investing at Laurel Wealth Planning.

ESG, SRI and impact investing

There are a few flavors of values-based investing to understand:

- Environmental, social, and governance (ESG) investing: In this common approach, people invest in stocks or bonds from companies/entities that are leaders in environmental, social, and governance issues. They may manage pollution risks, prioritize gender equality, treat workers well, create diverse boards, or have strong shareholder rights, among other actions. This approach aims to invest in good corporate citizens that can generate an above-market return and reduce risk.

- Impact investing: This is where people invest in companies or projects whose top goal is a societal or environmental impact. This might be an investment in a water conservation engineering company or an affordable housing lender. This approach prioritizes the impact of an investment over returns.

- Socially responsible investing (SRI): This style of investing excludes companies or industries that by classification do not match the investor’s ethical framework or mission statement. For instance, a public pension might want to avoid investing in tobacco companies due to the public health burden of tobacco.

ESG and SRI are a similar style, but ESG looks at both “who’s bad” and “who’s good” from a total perspective, whereas SRI investors tend to focus more on excluding certain industries or companies that make headlines for the wrong reasons. In this sense, ESG investing is a “positive screening” approach, while SRI is a “negative screening” approach.

The below figure from the Principles for Responsible Investment, supported by the United Nations, provides good examples of key factors ESG investors consider.

LWP’s approach

We have over 20 years of experience in ESG and socially responsible investing as part of our comprehensive approach to wealth management.

For clients who want their portfolio to align with their values, we’ve created an ESG plus approach. We believe this flexible approach is the best way to help our clients live their values and achieve their financial objectives. Here’s how it works:

- Client Focused: We seek to understand how values-based investing fits into a client’s priorities and build a portfolio that works to achieve their financial objectives within that framework.

- ESG Driven: For clients with an ESG objective, we prioritize investing in ESG leaders as a well-grounded way to build a portfolio structured for long-term performance with reduced risk. Like our clients, we’re often focused on strategies that evaluate investments based on environmental, gender equity, and racial equity factors.

- Flexible: We add investments that we think have diversifying or risk-reducing properties, even if they don’t have an ESG label. For instance, few alternative investments carry an ESG label. Flexibility enables us to pursue our primary goal—helping our clients achieve their financial objectives.

- Deeply Researched: We dive deep into every investment strategy included in our diversified portfolios to make sure they live up to our high standard. Our portfolios might include funds that select stocks and bonds based on ESG factors, funds that use ESG criteria as a primary component of their investment strategies, or funds that incorporate ESG measurement into their investment process.

- Impact Enhanced: We select impact-driven strategies that focus on a priority such as water infrastructure or racial equity to diversify portfolios and provide exposure to unique asset classes. We find investments that marry a sustainability or social impact goal with a compelling investment objective.

Does ESG investing work?

For us, this is the most important question. It can be broken down into two parts: “Does ESG investing help clients achieve their objectives and keep up with/outperform standard investors?” and “Does ESG investing do any good?”

First, does ESG investing help clients achieve their objectives and keep up with/outperform standard investors?

Simply put, yes. We think an ESG approach to investing can enable our clients to keep up with a standard, non-ESG approach and in some cases outperform.

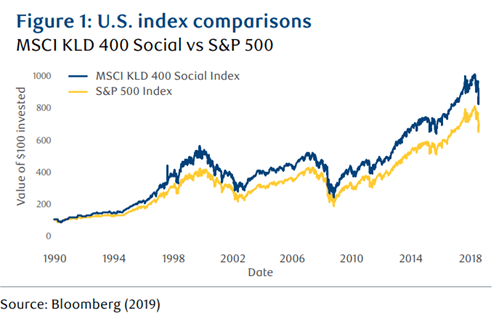

Multiple industry studies, such as this one from RBC Global Asset Management, have shown that a values-based investing framework can keep up with the market and sometimes outperform it. RBC compared the returns of an ESG Index (the MSCI KLD 400 Social) with the S&P 500. The ESG index outperformed over the period of 1990 – 2018 (see figure below).

However, it’s important to note that not all ESG investment approaches beat a standard investment approach. When it comes to ESG, the details matter. Paying attention to them to build a strong portfolio is where we strive to add value for our clients.

Does ESG investing do any good? Here again, we say yes.

As more investors large and small prioritize values in their portfolio, these investors force companies, entities, and municipalities to invest in promoting those values.

A 2021 study showed that ESG investors make it easier for companies that reduce their greenhouse gas emissions to raise capital from investors and harder for polluters to attract new investors. In turn, investors encourage companies to invest in green projects by lowering the cost to do so.

Companies are being encouraged by investors to prioritize gender and racial equality, shareholder protections, and broadly many of the values that ESG investors prioritize.

What does ESG investing cost?

This is also an important question for us, because as stewards of our client’s investment portfolios, we’re responsible for maximizing the value they get for the cost of their investments.

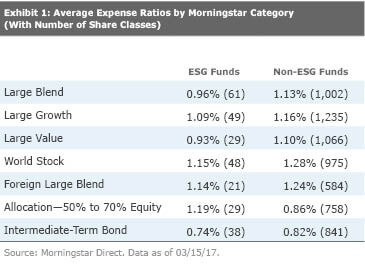

ESG funds can cost more than non-ESG funds, particularly ultra-low cost, passive index funds. For example, the iShares MSCI KLD 400 Social ETF, which tracks the index we discussed previously, has an expense ratio of 0.25%. Meanwhile, the SPDR S&P 500 Trust ETF, which tracks the S&P 500, has an expense ratio of 0.09%. (These expense ratios — the annual fee as a percentage of your investment — are according to Morningstar Advisor Workstation.)

However, ESG funds are not universally more expensive. A Morningstar study found that the average expense ratios for ESG funds are generally lower than non-ESG funds, as shown in this chart:

Getting started

We think ESG investing is a compelling approach for clients who want their values to align with their investment portfolio. Our ESG plus portfolio helps clients “get the best of both worlds.”

Please ask your advisor if you have any questions about values-based investing or ESG plus.

Laura, the founder of LWP, is a Senior Wealth Manager, Chief Investment Officer and Shareholder. She has a master’s degree in tax and is an excellent listener. While she is a sophisticated financial planner with experience in complex issues, her priority is ensuring a financial plan works for people.