Our Tax Planning Approach

Tax planning has always been an integral part of our wealth management services. We customize investment decisions to your personal tax situation and use multiple strategies to enhance after-tax returns.

While we don’t prepare taxes or do accountancy, we dive deep into tax reduction strategies. We look at our clients’ tax returns every year and prepare high-level tax projections when analysis is needed. This gives us an overall sense of their tax situation. We work hand-in-hand with a client’s CPA to find tax opportunities.

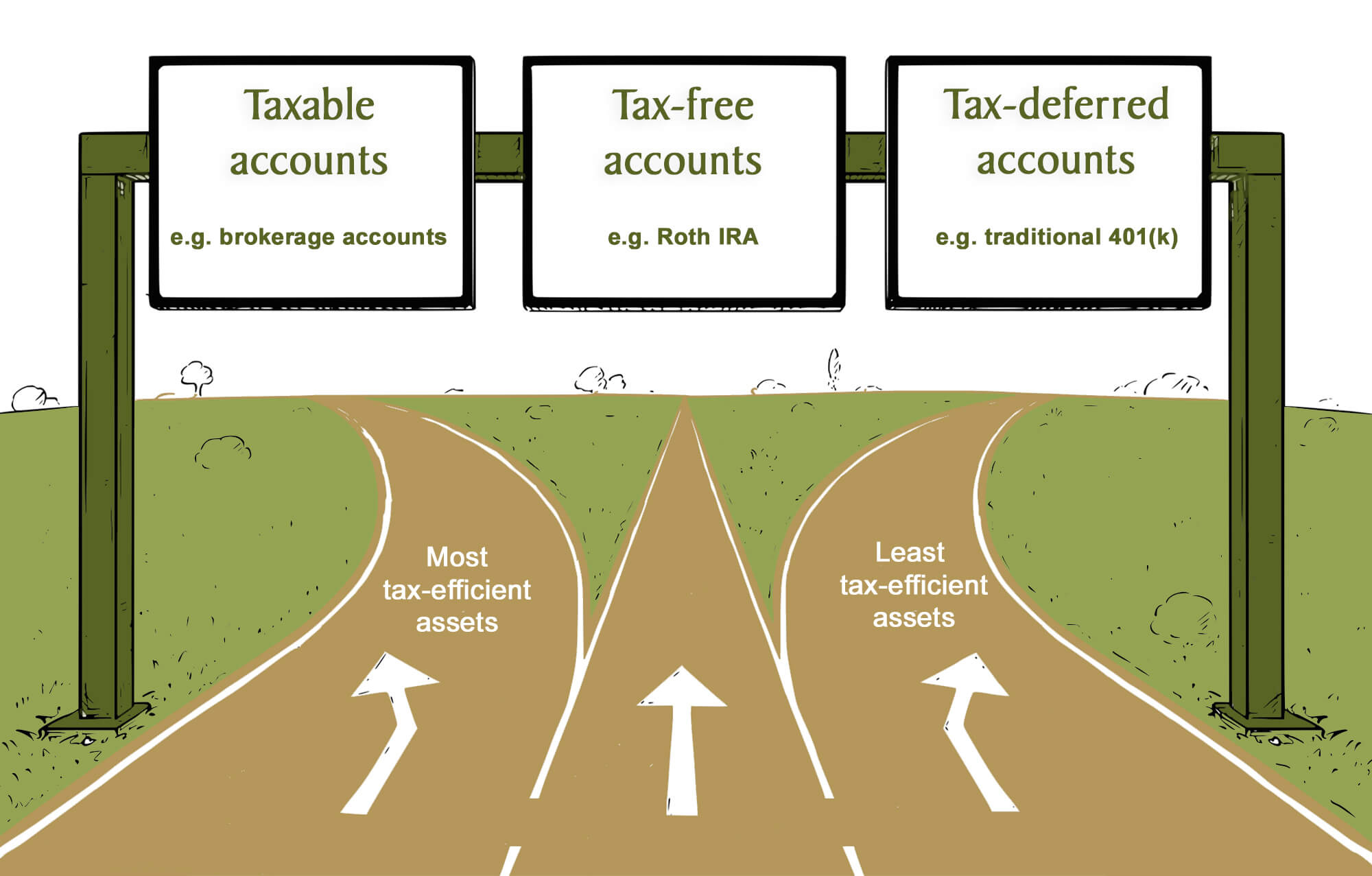

Tax location planning

A major tax planning opportunity is tax location planning. This means matching an investment account’s tax characteristics to an investment’s tax characteristics.

For example, you don’t want to put a tax-free municipal bond into a regular IRA. Doing so would take tax-free money and make it taxable. We put most growth assets in Roth IRAs, while putting investments that don’t get a tax break into tax-deferred accounts. We allocate investments that do get a tax break to taxable accounts.

Other opportunities and strategies to enhance after-tax returns can include:

- Roth IRA conversion planning

- Maximizing advantages of HSAs, 401ks, IRAs and other accounts for retirement planning

- Strategic recognition of capital gains and losses

- Emphasizing long-term capital gains.

- Charitable giving planning

- Qualified dividends

- Appropriate use of tax-free bonds

Long-term and real-time data

We analyze our client’s tax planning plan both in the short-term and long-term. We know which years will likely be high tax or low tax years and know when things will shift. We also have our clients’ investment data right on our computer. We know the tax basis, taxable gain, projected income, what might work well for charitable giving, etc.

With the above information at our fingertips, we can both plan ahead to enhance our clients’ tax savings and react quickly to capitalize on opportunities. When a tax law changes, we know exactly who will be affected and we adjust their portfolio accordingly. When global trends change, we know who has certain kind of investments, what the tax implications are, and what needs to be done next. In our regular meetings, we suggest further tax reduction strategies.

Studies have shown the potential value of our tax planning approach. An Envestnet study indicates value of 1% per year beyond fees; a Russell study indicates 0.5% beyond fees. Vanguard’s 14-year study indicates up to 0.75%.

Because we are comprehensive wealth managers, our clients receive many other services as well, creating an overall high-value service. With ongoing wealth management, rather than a point-in-time financial plan, we have lots of data to make recommendations and make updates in real time on an ongoing basis. As importantly, our clients have someone to explain the implications of any changes and why it may make sense to take certain steps. Attention to tax planning is one piece of this puzzle.