Student loans are in the news again, as payments on federal loans are resuming for millions of borrowers.

Due to the COVID-19 emergency, federal student loans had been in forbearance since 2020, meaning payments were not due and no interest accrued on the debt. However, that forbearance is ending.

The student loan repayment pause ends on October 1, 2023. Interest on loans began accruing again on September 1, 2023.

I’ve been getting some questions about what this all means and how it will impact your loved ones with student loans, so I wanted to share some knowledge and resources that you could pass along.

First and foremost, student loans are complicated! It’s always a good idea to consult with a professional who specializes in this issue if you’re not sure about next steps. The resources below are meant to be starting points, not necessarily definitive answers for every possible scenario.

Who is affected?

To be clear, the changes are only to federal student loans. Private loans are unaffected by this policy, so make sure you know what type of loans you are dealing with. If you have private loans and are unsure of their status, contact your loan provider directly.

Getting started

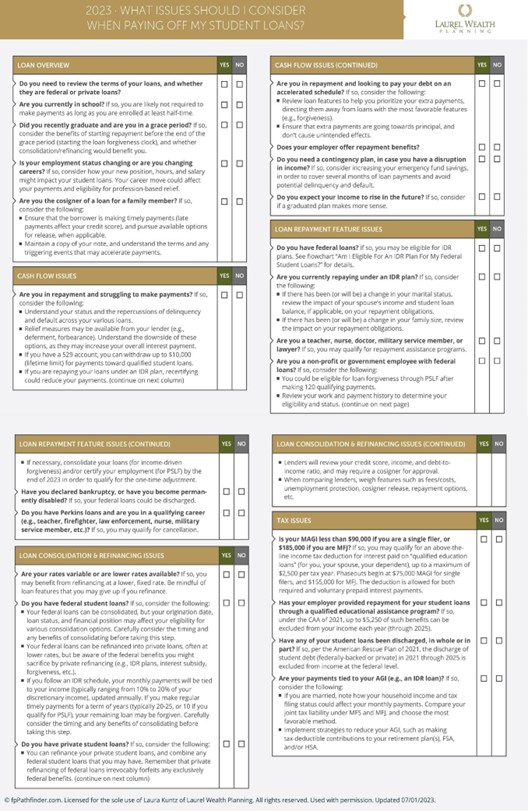

Here’s a chart to help you think through your next steps. Click to open a PDF version:

Public service loan forgiveness

People working towards the Public Service Loan Forgiveness program (PSLF) or the Temporary Expanded Public Service Loan Forgiveness program (TEPSLF) will still be eligible once payments resume.

The program requires a minimum of 120 (10 years’ worth) monthly payments for people working for eligible employers. This typically includes the government or specific types of non-profit organizations.

If you meet all the other qualifications, you will get credit as though you have made monthly payments during the pause, so you shouldn’t be delayed in earning the forgiveness.

Tax refunds

During the forbearance program, you might still have made payments. People who voluntarily made payments and requested a tax refund received one. However, now that payments are starting up again, those refunds are being added back to borrowers’ loan amounts.

Look carefully at your loan amount, the amount you have paid, and any refunds you received to ensure everything is correct. If you think there are errors, contact your loan provider.

The best way to find your federal student loan provider is to log into the studentaid.gov servicer finder.

Tax implications

Student loans can affect your taxes in a variety of ways, including being able to deduct up to $2,500 of student loan interest each year.

I wish I could give you one definitive answer for what student loans will do to your taxes, but it varies greatly. Factors like the amount owed, what type of loan you have, and your annual income all play a part in your tax burden.

Make sure you speak to your tax professional to understand your best options regarding student loans and your taxes.

More student loan resources

As I mentioned earlier, student loans are complicated. While the information above is a good way to get started, here are some more resources that might be helpful. Of course, interview anyone carefully before hiring, and make sure you find someone who understands your specific financial situation and needs.

- For physicians and other high earning professionals where forgiveness and other strategies may be an option: Navigate

- For millennials: Bona Fide Finance and Gen Y Planning

Jesse bridges the gap between clients’ personal and financial goals, with focus and energy.