2022 was a year of change and joy for me personally, and also a year of changes in investing.

In August, my eldest child, Rachel, married Erik. They (along with their parents) hosted a beautiful event in downtown Minneapolis along the Mississippi River. Their wedding was everything they wanted it to be and I was so happy for them.

Then, Tom and I bought a townhome, which is still being built, in Savage, a suburb of Minneapolis. It’s quite an experience to build a new home during a time of supply change kinks and labor shortages.

2022 at Laurel Wealth Planning

Laurel Wealth Planning experienced some staff turnover and wonderful staff dedication this year. Our team members completely stepped in to serve you, and I hope that you noticed little change.

As a firm, we are committed to our publicly shared values, including “Fully Reliable” and “Go the Extra Mile.” You will soon have the opportunity to give us feedback in a client satisfaction survey we’ll be sending you – and we will so appreciate your feedback and thoughts, whether positive or constructive.

While seeking to serve you well, we were very fortunate that both you, our clients, and other friends of LWP referred folks to us who wanted help. We continue to carefully grow LWP with quality and loyalty all along the way, and, I am thankful to say that we exceeded our business goals in 2022. Rest assured that Laurel Wealth Planning continues as a strong firm.

I am deeply grateful to you for your trust and confidence in us. It is a joy to me – and our team members – to make a difference for you. Bear markets are not an easy time for most investors. That said, they are a time to take advantage (as suitable) of attractive valuations through strategic purchases and tax strategies (what we call a “contrarian” approach). Bear markets are also a time for us to show you the strength of your financial plan, i.e., that you can weather the storm, take advantage of opportunies, and live as you choose. That is what wise investing and financial planning is all about.

Investing in 2022

2022 was also a year of changes in investing:

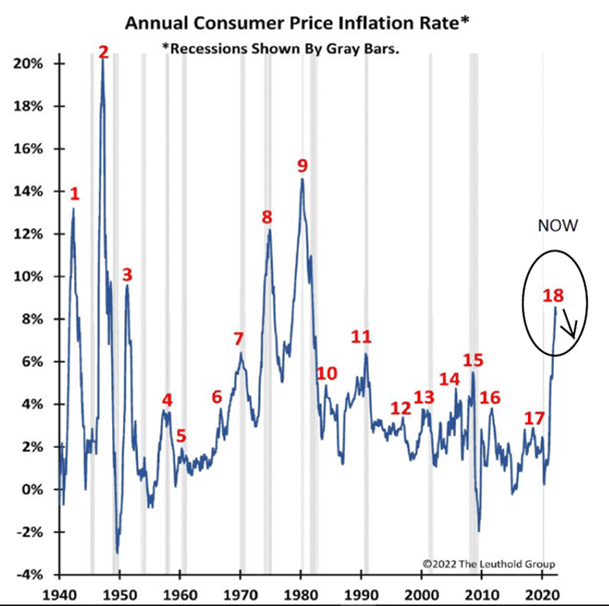

- Inflation jumped with the U.S. Consumer Price Index hitting 9.1% in June.

- Unemployment hit a resounding low of 3.7% with 1.7 jobs available for each unemployed person. When you think of your stock portfolio, know that recruiting and retaining employees likely became your companies’ top business concern in 2022.

- Entering 2022, home-buying continued frenzied with multiple offers over the asking price for many homes. With mortgage rates now having risen from approximately 3% to 7%, houses are now sitting on the market for closer to normal periods.

- Russia’s attack of Ukraine in February sent oil prices sky rocketing, making oil was one of the few positive investment categories in 2022.

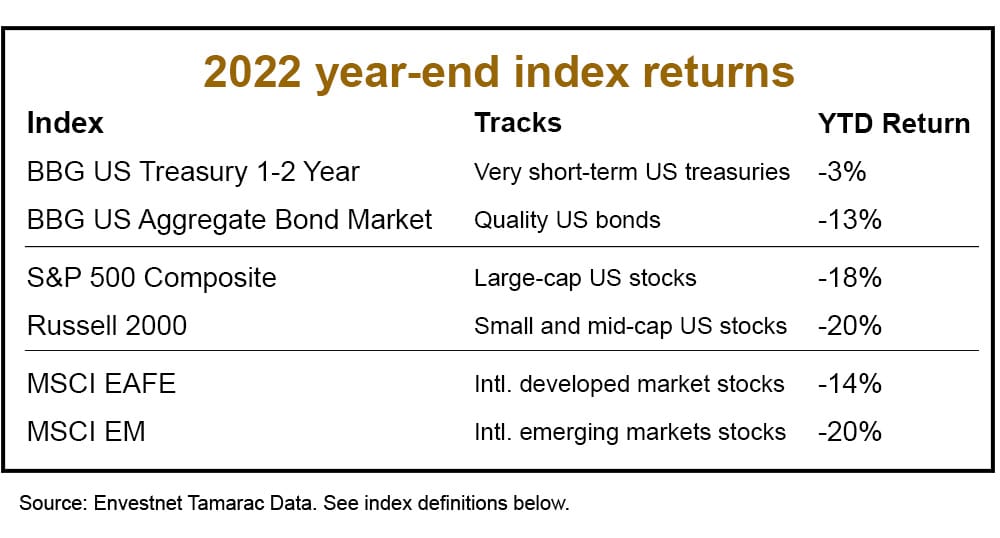

As a result of these challenges, the world stock and bond markets entered a bear market. See index results below. You can also check your portfolio results as compared to broad indices on your LWP portal under Account Performance.

Our outlook for 2023

We are looking toward better things by year end 2023.

We expect that inflation will continue to drop – in fits and starts. Historically, inflation has dropped off in a “V,” i.e., sharp drop pattern, and this is already occurring.

We will likely experience a recession or very mild growth in the coming months, but as Dr. Kelly of JP Morgan says, “It is hard to get hurt when you fall out of a basement window.” In other words, if unemployed folks move from having 1.7 job opportunities apiece to 1, they will still be in good shape. Once we work our way through any recession, economic growth is expected to improve, especially as we look to year end 2023.

Quality bonds experienced unusually poor results in 2022, with the U.S. Bloomberg Aggregate Bond Index posting -13%. This is the worst downturn since the 2008-2009 Great Recession. However, as we look forward, bonds are poised to do well over the coming several years. This piece by Kathy Jones of Charles Schwab does a nice job of summarizing the opportunities.

International stocks offer potential. Large international stocks fared better in 2022 than did large U.S. stocks, even with the challenges Europe faced with the Russian/Ukranian war: -14% for international compared to -18% in the U.S., as shown in the index data above.

Before 2022, an enormous driver of U.S. large stock growth had been the performance of just a few technology companies. Results in 2022: Microsoft -28% Apple -31% Amazon -49% Meta (Facebook) -63%. Of course, each of these companies faces challenges particular to its decision making and business model, but, in general, rising interest rates are harder on growth companies, and inflation is starting to impact results. Diversification vs. a concentration on high-flying growth stocks performed better in 2022 and has the potential to out-perform as we look forward to a mild recession/mild growth scenario in 2023.

Energy transitions

Lastly, the world is going through an energy transition from fossil fuels to renewables. This is evidenced in a variety of ways:

- Demand for electric/hybrid vehicles in the U.S.

- 22% of U.S. electricity comes from renewables.

Our team is focused on helping you build and maintain your wealth. We won’t speculate as to whether this transition is fast enough nor will we comment on associated political positions. However, the energy transition is a theme that will be running through investing for some time to come and you will hear us talking more about it. Keep in mind that not every renewable opportunity is a good investment; many are now overpriced. However, formal evaluation/audit of companies based on their sustainability footprint is likely coming. This is an area that companies, and therefore investors, will likely need to consider.

While we are relatively optimistic for 2023, we are always at the ready for changes or surprises. We will keep you apprised, as always, if the landscape shifts. And we welcome questions, comments, and concerns about anything you see going on in the world and how it might affect your financial plans.

Index definitions

Bloomberg Treasury 1-2 Year Index: This index is comprised of U.S. treasury securities with a duration of 1-2 years. Treasury securities, like other bonds, can rise and fall with interest rates and other factors.

Bloomberg U.S. Aggregate Bond Market Index: A representation of SEC-registered, taxable, and dollar denominated securities. The index covers the U.S. investment grade fixed rate bond market, with index components for asset-backed securities, government and corporate securities, and mortgage pass-through securities. Must be rated investment grade (Baa3/BBB- or higher) by at least two of the following rating agencies: Moody’s, S&P, Fitch; regardless of call features have at least one year to final maturity and have an outstanding par value amount of at least $250 million.

S&P 500 Composite: Representing approximately 80% of the investable U.S. equity market, the S&P 500 measures changes in stock market conditions based on the average performance of 500 widely held common stocks. It is a market-weighted index calculated on a total return basis with dividend reinvested.

Russell 2000 Index: The index measures the performance of the small-cap segment of the US equity universe. It is a subset of the Russell 3000 and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

MSCI EAFE (Europe, Australasia, Far East) Index: A free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of June 2, 2014, the index consists of 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

MSCI Emerging Markets (EM) Index: A free-floating index offered by Morgan Stanley that captures mid and large capitalization stocks across more 26 countries including many in S. America, Eastern Europe, Africa, the Middle East, and parts of Asia, including Indonesia, the Philippines, and Taiwan.

Laura, the founder of LWP, is a Senior Wealth Manager, Chief Investment Officer and Shareholder. She has a master’s degree in tax and is an excellent listener. While she is a sophisticated financial planner with experience in complex issues, her priority is ensuring a financial plan works for people.