At Laurel Wealth Planning, we are honored to help our clients navigate their financial journeys, helping their money work as effectively as possible to support their life goals. Whether it’s preparing for retirement, managing investments, or structuring tax-efficient strategies, our role as fiduciaries is to provide strategic guidance that aligns with your values and aspirations.

Back in December 2020, we explored this important topic, and now we’re providing an updated perspective—read our original post here and see what’s changed.

If you are a current client, this article highlights the ongoing value we’re already providing to your financial life.

Quantifying the Value of Financial Advice

If you’re considering working with a financial advisor, you may wonder: “How do I know they will add value?” A recent industry analysis quantifies the financial impact of working with an advisor, and the findings are clear: professional guidance can significantly enhance wealth accumulation and retention.

- After accounting for inflation and fees, investors working with a financial advisor experience an estimated 36% to 212% more wealth accumulation over their lifetime, depending on their starting age and net worth.

- Advisor-managed portfolios generate an annual return premium of 2.39% to 2.78%, even after fees, compared to those managed independently.

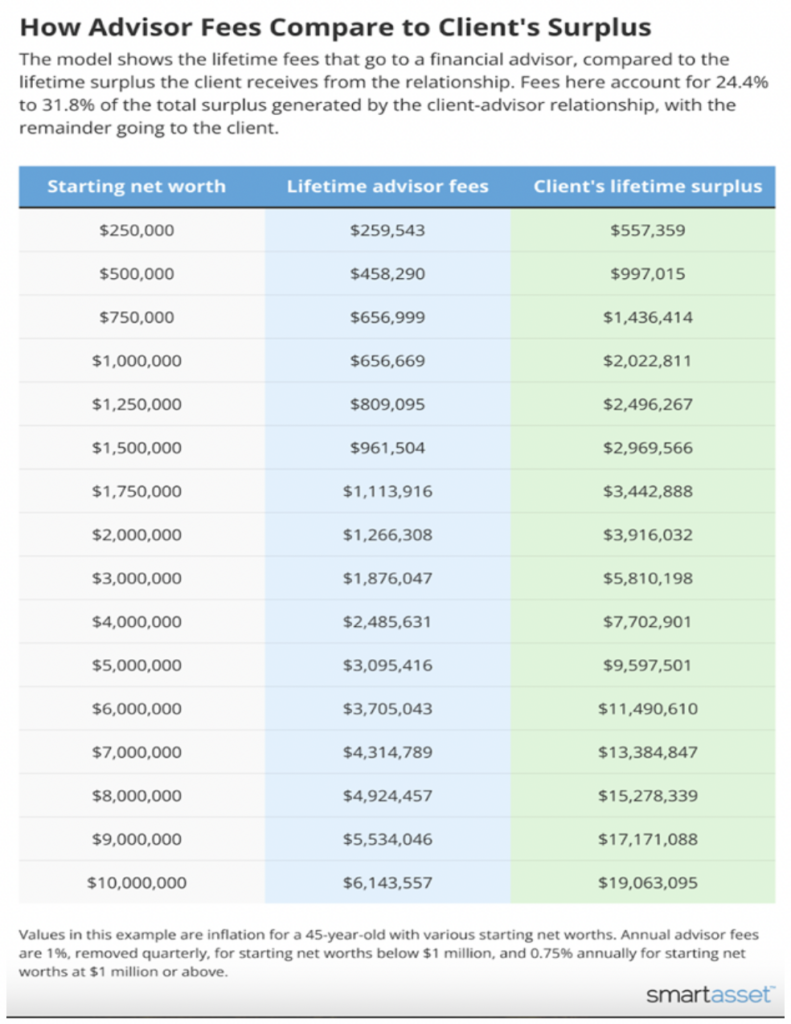

- Over a lifetime, the total value generated by a financial advisor surpasses their fees, with advisors capturing 23% to 35% of the value surplus generated, meaning clients retain the majority of the financial benefits.

This additional value comes from two primary areas:

- Investment Gains: Professional management helps maximize portfolio returns, maintain asset allocation discipline, and avoid costly investing mistakes.

- Tax Savings: Advisors optimize tax strategies, such as tax-efficient investment placement, withdrawal sequencing, and charitable giving techniques, to reduce tax liabilities over time.

Projected Lifetime Value of a Financial Advisor

A financial advisor’s value compounds over time, significantly impacting long-term wealth. Based on conservative estimates, the research model projects:

- A $1.5M investor can expect a $2.9M+ surplus over their lifetime.

- A $4M investor can accumulate an additional $7.7M+ in wealth.

- A $10M investor may realize over $19M in lifetime gains.

These projections demonstrate that the cost of an advisor is a fraction of the value they provide, with professional financial guidance playing a crucial role in optimizing wealth.

Investment and Behavioral Guidance: A Critical Advantage

Beyond just growing your wealth, a financial advisor helps preserve it as well. Managing investments effectively requires not only knowledge of the markets but also the ability to navigate behavioral biases that can lead to costly decisions.

Avoiding Costly Investment Decisions

Investing is often about human behavior. During periods of market volatility, investor concern or overconfidence can lead to decisions that may negatively impact the investor’s long-term financial success and their wealth.

At Laurel Wealth Planning, we’ve seen firsthand how investor decision-making can disrupt even the best-laid financial plans. Some common pitfalls include:

- Reacting to market swings: A sustained downturn prompts an investor to pull back, selling stocks at a loss — only to miss the eventual market rebound and potential gains.

- Holding on to underperforming assets: Sentimental attachment to an inherited stock portfolio or real estate holdings may cause an investor to keep assets that no longer align with their financial goals.

- Overconfidence in a single strategy: Some investors allocate too much to one asset class—such as growth stocks or certain individual stocks—without considering broader diversification, increasing their risk exposure.

The LWP team helps clients take a rational, strategic approach to investing, so decisions are based on financial principles rather than short-term feelings. With our guidance, clients stay focused on their long-term goals, avoid reactions, and capitalize on opportunities that align with their financial vision.

The Technical Side of Wealth Management

Beyond behavioral guidance, financial advisors navigate complex financial landscapes shaped by ever-evolving market conditions, tax laws, and investment products. Key areas where professional guidance adds value include:

- Tax planning: Advisors strategically reduce tax liabilities through tax-loss harvesting, Roth conversions, and charitable giving strategies.

- Investment strategy: Portfolio allocations are tailored to risk tolerance, time horizons, and evolving financial needs.

- Regulatory & economic changes: Legislative shifts, trade policies, and market trends are proactively monitored to adjust financial strategies accordingly.

This proactive approach keeps clients’ financial plans optimized in an ever-changing landscape.

How to Find the Right Financial Advisor

When you choose a financial advisor, you’re looking for a trusted partner who understands your financial needs and long-term vision. When selecting an advisor, consider asking the following questions:

Fiduciary Commitment & Transparency

- Are you always held to a fiduciary standard? How do you prioritize my best interests?

- How are you compensated? Do you accept commissions or referral fees? If so, will you itemize the amount of compensation you earn from products you recommend to me?

- What is your fee structure, and how does it align with the value provided?

Financial Planning & Investment Approach

- Do you provide comprehensive financial planning or just investment management? What is your process?

- What is your investment philosophy, and how do you manage risk?

- How do you integrate tax planning and estate planning into your financial strategies?

Client Experience & Relationship Management

- How will you help me reach my financial goals?

- How frequently do you communicate and adjust financial plans?

- How many clients do you currently have?

- Do you have many clients like me?

Regulatory & Continuity Considerations

- Have you ever been disciplined by the SEC or FINRA?

- What happens to my relationship with the firm if you leave?

A complimentary consultation is a valuable opportunity to discuss your goals, evaluate an advisor’s approach, and determine whether their strategies align with your expectations. At Laurel Wealth Planning, we believe in building long-term partnerships that reflect your values, priorities, and aspirations.

For our existing clients, we hope this overview reinforces the value of our ongoing partnership. We remain committed to providing these advantages and more to your financial life as we continue our work together.

Maximize Your Financial Potential With Laurel Wealth Planning

We understand financial decisions can feel overwhelming, but you don’t have to navigate them alone. Our fiduciary team is dedicated to helping you maximize wealth, minimize taxes, and make informed decisions that align with your goals.

Are you ready to see how professional financial guidance can benefit you? Schedule a complimentary consultation today and explore strategies and opportunities that may add value for you—and help you realize your financial goals.