Financial decisions aren’t made in a vacuum. They’re personal, often emotional, and sometimes made during moments of stress, transition, or uncertainty. Whether you’re preparing for retirement, navigating a divorce, selling a business, or reacting to market volatility, emotions are almost always in the room, even if they’re not always easy to spot.

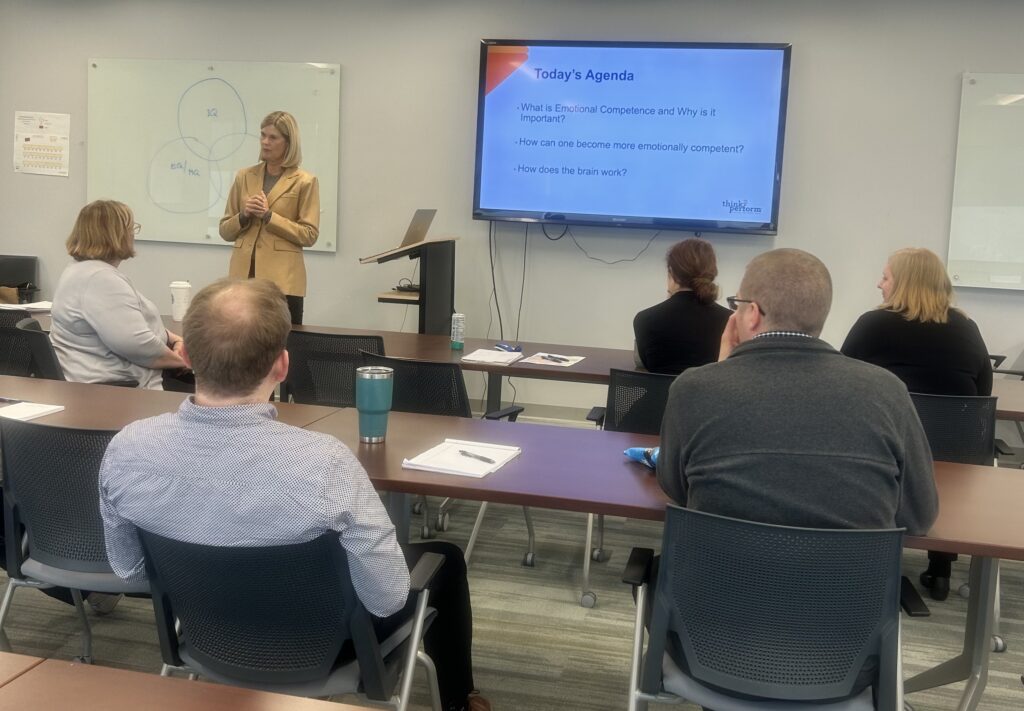

At Laurel Wealth Planning, we don’t ignore that reality; we lean into it. That’s why our team recently completed specialized emotional intelligence (EQ) training. It’s part of our commitment to helping you make not only smart financial choices but ones that feel aligned, grounded, and reflective of your values.

We’ve always believed great planning starts with great listening. But now, with this training, we’ve deepened our ability to recognize emotional undercurrents, whether it’s hesitation, urgency, or anxiety, and help you navigate them with clarity and confidence.

Why Emotions and Money Are So Closely Linked

Money represents much more than numbers in our bank accounts. It can carry memories, stress, pride, identity, and hope for the future. So when you’re facing a big financial move, it’s completely normal to feel overwhelmed or unsure.

Have you ever considered pulling your money out of the market during a downturn, even when you knew it might not be the best long-term move? Or felt hesitation about creating an estate plan because it brought up difficult emotions around aging or family dynamics? That’s emotional decision-making at work.

These moments are common, and being emotionally aware can help you navigate them with more certainty and less regret. Our EQ training gave us tools to meet those moments with more presence to better understand it and guide you through it.

Avoiding the Most Common Financial Pitfalls

Emotions like fear of loss, anxiety about the unknown, or even overconfidence can cause people to make choices that don’t connect with their long-term goals. These reactions are often subtle, but they can have a big impact.

One common example is selling off investments before an election due to fear of market shifts, only to miss out on a rebound. Or perhaps you’ve rushed into a major financial decision during a life transition, without fully thinking through the long-term consequences.

Being emotionally aware doesn’t mean you won’t feel nervous or uncertain. It simply means you’re more equipped to pause, breathe, and choose a response that serves your future vision.

The Power of Feeling Seen and Supported

The best financial relationships are built on trust, honesty, and space to talk about what really matters. When emotions are acknowledged and respected, people tend to feel more confident, more informed, and more in control of their decisions.

That kind of support can be especially important during high-stakes transitions like selling a business, losing a loved one, or sending your kid to college. These are not just financial events; they are emotional milestones.

Our EQ training helped each member of our team become more self-aware in conversations: how we listen, how we respond, and how we help you feel steady, even when things around you are not.

It also gave us language and frameworks to guide you through emotionally sensitive topics with more empathy and less overwhelm so you walk away not just with a financial plan, but with peace and clarity.

A Quiet Advantage: Emotional Intelligence in Your Corner

At Laurel Wealth Planning, we know that financial decisions don’t happen in a vacuum. They’re often wrapped up in life transitions that come with stress and uncertainty. That’s why we’ve made emotional intelligence (EQ) a key part of how we support our clients.

Recently, our team completed a specialized EQ training designed to help us better serve you both as investors and as people navigating real-life decisions. It gave each of us deeper insight into how we show up in conversations (especially when emotions are running high) and how to create a space where you feel heard, respected, and guided with clarity.

Whether you’re facing a major life change, weighing complex trade-offs, or simply want to feel more confident in your financial plan, having emotionally intelligent support in your corner can be a quiet but powerful advantage on the path to long-term success.

In the End, It’s More Than Money

Financial success is created not only from having a strong strategy in place, but from knowing that your decisions match what matters most, including your values, your goals, your family, your future.

Emotional intelligence helps us—and you—recognize what matters most and build a plan around it.

The Laurel Wealth Planning LLC team can help you build a plan that feels more grounded, more purposeful, and more free. To schedule a complimentary meeting, email laurel.wealthplanning@laurelwealthplanning.com or call (952) 854-6250. Find out if the Laurel Wealth Planning team is the right financial advisor for you.

Important Information & Disclosure:

The foregoing content was prepared by Indigo Marketing Agency with verbiage, opinions and/or financial commentary input provided by Laurel Wealth Planning.

The foregoing content reflects the opinions of Laurel Wealth Planning LLC and is subject to change at any time without notice. Content provided herein has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets, or developments mentioned. The content is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful.

As a precautionary measure, we cannot rely on e-mail requests to authorize, direct, or affect the purchase or sale of any security, wire transfer, or to affect any other transactions. Such requests, orders, or other instructions sent via email should be confirmed verbally or by written instructions faxed to 952-854-6250 prior to their anticipated execution. We are unable to ensure that emails sent to you from us, or sent from you to us, will be received. Please contact us at 952-854-6250 if there is any change in your financial situation, needs, goals, or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions. Additionally, we recommend that you compare any account reports from Laurel Wealth Planning LLC with the account statements from your custodian. Please notify us if you do not receive statements from your custodian on at least a quarterly basis. Our current disclosure brochures, From ADV Part 2 and Form ADV Part 3, are available upon request and on our website, www.laurelwealthplanning.com. This disclosure brochure, or a summary of material changes made, is also provided to our clients on an annual basis.

Laurel Wealth Planning LLC (LWP) is an Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply any level of skill or training. LWP is a wealth management firm and does not practice law or accountancy. The information and material contained in this communication is confidential and intended for the recipient addressee named. If you are not the intended recipient, please delete the message and notify the sender immediately. The foregoing content was prepared by Indigo Marketing Agency with verbiage, opinions and/or financial commentary input provided by Laurel Wealth Planning.