My husband, Tom, does not always enjoy the sometimes wild rides of the stock markets. This cartoon made me chuckle.

After the bear market of 2022, markets jumped in late 2023 on the expectation of future interest reductions, ending 2023 in solidly positive territory. Many types of bonds were up, as well as stocks. The 2023 upswing brought your 2022 “buy lows” (implemented as suitable) into nicely positive territory. For example, the October buy low is now up more than 30%.

2023 Investment Index Examples

| Investment type | 2023 return |

| Bloomberg 1-3 Year Treasury Index | +5% |

| U.S. Quality Bonds (Bloomberg Aggregate) | +6% |

| Global Bonds (Bloomberg Global Aggregate) | +6% |

| International Emerging Markets (MSCI EM) | +10% |

| Small/mid U.S. Stocks (Russell 2000) | +17% |

| International Developed Countries (MSCI EAFE) | +18% |

| Large U.S. Stocks (S&P 500) | +26% |

Outlook for the coming year

Our outlook for the coming year is constructive. We believe that the next 2-3 months may bring positive results, with a possible rotation away from the overbought “Magnificent Seven” (Microsoft, Amazon, Alphabet, Apple, Nvidia, Tesla, Meta) to the sectors that lagged in 2023 and, therefore, have upside potential, i.e., small/mid stocks, dividend-paying stocks, etc.

After that, we believe that election fears may reduce markets, because markets hate uncertainty. Markets are often positive after elections, no matter who is elected, simply due to the increased clarity. All in all, we look for 2024 markets to end in positive territory with the key driver being declining interest rates.

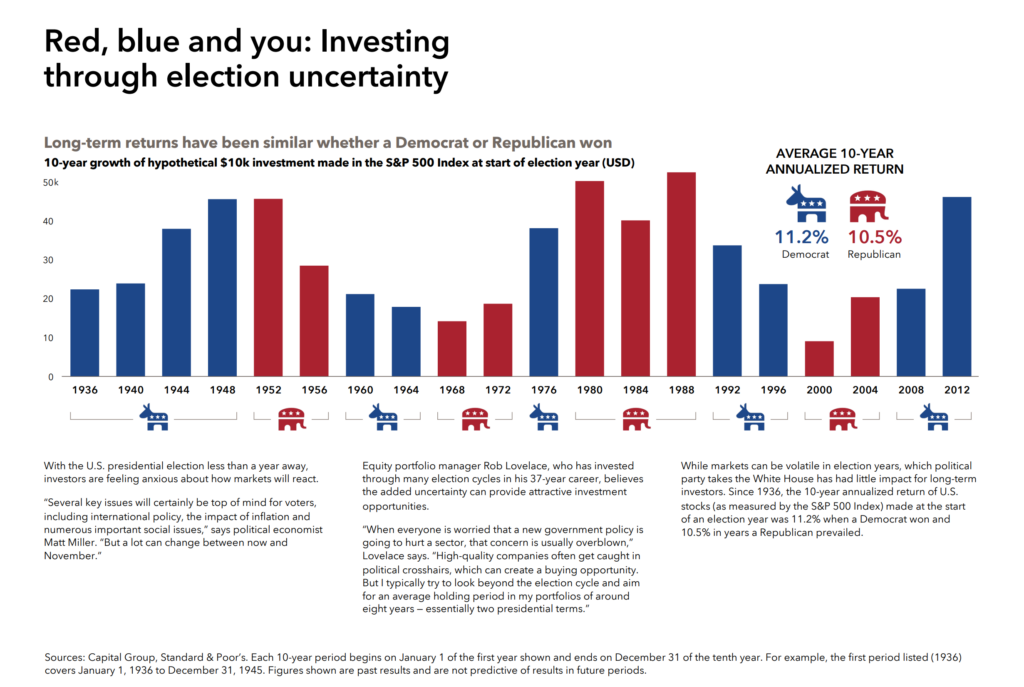

Many clients are asking us about the upcoming presidential election. Of course, there is always the possibility of an event that is destructive to our system. Barring that, long-term returns historically have been similar whether a Democratic or a Republican is elected.

More Detail: We like the Capital Group’s Summary for 2024. If you enjoy reviewing investment details, take a look.

International fossil fuels update

Are we starting to see the beginning of the end of the fossil fuels era? As you may remember, when I visited Europe, I was impressed by the many solar panels on homes, whether old homes or newer, whether steep roofs or flat. See this article about the annual U.N. Climate Conference, which was held in, of all places, a petro state. And for the first time ever, the conferees, many from petro states, added this to the agreement, “Transitioning away from fossil fuel in energy systems, in a just, orderly, and equitable manner, accelerating action in this critical decade, to achieve net zero by 2050 in keeping with science.” Imagine agreeing to that when your country’s key business is oil.

New form for business owners

Now for the challenging news: business owners have another government form to file — for Beneficial Ownership. The goal of this form is to avoid money laundering by clarifying to federal authorities who truly owns companies. If you run any type of business, including any small home business, self-employed, 1099 business, or Schedule C business, please consult your CPA or tax advisor at your early convenience about whether this filing requirement applies ot you. One CPA with whom we discussed this requirement said that the penalities for non-compliance are “massive.” Consider sending this information to anyone you know who has any type of business.

Index Definitions

- Bloomberg 1-3 Year Treasury Index: Measures the performance of the US government bond market and includes public obligations of the U.S. Treasury with a maturity between 1 and up to (but not including) 3 years.

- Bloomberg U.S. Aggregate Bond Market Index: A representation of SEC-registered, taxable, and dollar denominated securities. The index covers the U.S. investment grade fixed rate bond market, with index components for asset-backed securities, government and corporate securities, and mortgage pass-through securities. Must be rated investment grade (Baa3/BBB- or higher) by at least two of the following rating agencies: Moody’s, S&P, Fitch; regardless of call features have at least one year to final maturity and have an outstanding par value amount of at least $250 million.

- Bloomberg Global Aggregate: A flagship measure of global investment grade debt from twenty-eight local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

- MSCI Emerging Markets (EM) Index: A free-floating index offered by Morgan Stanley that captures mid and large capitalization stocks across more 26 countries including many in S. America, Eastern Europe, Africa, the Middle East, and parts of Asia, including Indonesia, the Philippines, and Taiwan.

- Russell 2000 Index: The index measures the performance of the small-cap segment of the US equity universe. It is a subset of the Russell 3000 and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

- MSCI EAFE (Europe, Australasia, Far East) Index: A free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of June 2, 2014, the index consists of 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

- S&P 500 Composite: Representing approximately 80% of the investable U.S. equity market, the S&P 500 measures changes in stock market conditions based on the average performance of 500 widely held common stocks. It is a market-weighted index calculated on a total return basis with dividend reinvested.

Laura, the founder of LWP, is a Senior Wealth Manager, Chief Investment Officer and Shareholder. She has a master’s degree in tax and is an excellent listener. While she is a sophisticated financial planner with experience in complex issues, her priority is ensuring a financial plan works for people.