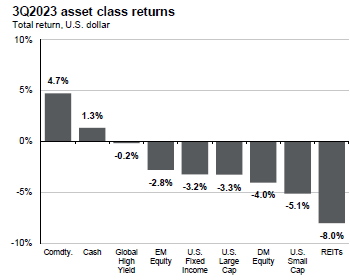

During the last three months, many investment categories have struggled. If we look at common categories, we see that only money markets and commodities posted positive returns. Several factors played into this result including:

- The sense that interest rates may be higher for longer.

- Some sticky or “structural inflation” at the 3% to 4% level.

- Stock values likely got ahead of themselves.

When we step back and look at the whole year, results are generally positive, but mixed:

- Large U.S. Stocks (S&P 500) +13%

- Small/mid U.S. Stocks (Russell 2000) +3%

- U.S. Quality Bonds (Bloomberg Aggregate) -1%

- International Developed Countries (MSCI EAFE) +8%

- International Emerging Markets (MSCI EM) +2%

Outlook: It is natural for stocks to get ahead of themselves then “cool off.” I also believe we are seeing a “reality check” in terms of future interest rates and inflation. That said, when the Federal Reserve Board (The Fed) does finally stop raising rates, we may well see a “pop” in stock values.

We also believe that bonds are likely to do well over the next several years. Bond coupon rates are running an attractive 4% to 7% (depending on bond type), and if and when The Fed does eventually cut rates, bonds may increase 10% for every 1% cut.1

Of Interest: The Japanese stock market is producing attractive results after many years of more modest returns. The Nikkei 225 (sometimes called the Japanese Dow Jones) is up 26% this year. As suitable, you’ll soon see us increasing the weighting of this stock market in your portfolio.

If you like River Cruises, I do highly recommend the Rhine. There was so much to see from castles to cathedrals to historic towns. And, with France on one side of the river and Germany on the other, the communities along the river have had to switch allegience between those two sides several times, creating a fascinating history and culture.

Please let me know your questions and comments. It is always a pleasure to hear from you.

Laura, the founder of LWP, is a Senior Wealth Manager, Chief Investment Officer and Shareholder. She has a master’s degree in tax and is an excellent listener. While she is a sophisticated financial planner with experience in complex issues, her priority is ensuring a financial plan works for people.