The recent stock market rally has been almost entirely driven by 10 companies in the S&P 500, accounting for over 95% of the index’s year-to-date performance1.

Here’s the list of companies driving the increase:

- NVDIA +190%

- Meta (Facebook) +139%

- Carnival Corporation +134%

- Tesla + 113%

- Royal Caribbean Cruises +110%

- Palo Alto Networks +83%

- Norwegian Cruise Lines Holdings +78%

- Advanced Micro Devices +75%

- Pulte Group +71%

- General Electric +68%

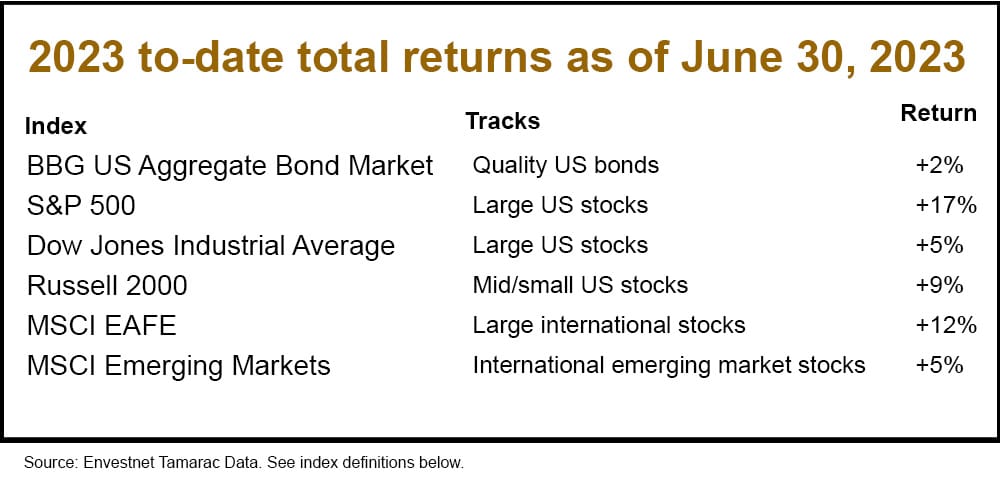

Compare those numbers to an S&P 500 up 17% and a Dow Jones Industrial Average (filled with more staid value-oriented or dividend-paying stocks) up a mere 5%. Key industry themes are artificial intelligence/technology, a return to travel, and the home inventory shortage. The return to travel is a continuing post pandemic trend. The housing inventory shortage is due to so many homeowners feeling “locked” into their home due to their current low interest rate. The artificial intelligence trend is newer.

Artificial intelligence

Just for fun, I checked Chat GPT (a research application built on artificial intelligence) for a few explanations on what AI is to help you understand this trend. I either quoted or paraphrased the answers:

Q: What is artificial intelligence (AI)?

A: “AI refers to the simulation of human intelligence in machines that are programmed to think and learn like humans. It involves the development of computer systems or algorithms that can perform tasks that typically require human intelligence, such as visual perception, speech recognition, decision-making, problem-solving, and language understanding … The applications of AI are vast and have the potential to automate tasks, enhance efficiency, provide personalized experiences, and contribute to scientific advancements, but it also raises ethical and societal considerations that must be carefully addressed.”

Q: What are some of the most advanced uses of AI?

A: Healthcare: read X-rays, robotic surgery. Self-driving vehicles. Understanding and interpreting human language. Advanced robots that can adapt to changing conditions and collaborate with humans.

Q: What are some daily uses of AI today?

A: Iphone’s Siri. Home device Alexa. Suggested products and news on social media. Speech to text conversion. GPS navigation. Automated language translators. You can see that you may be using AI today.

Q: How will AI permeate our lives in the years to come?

A: In the workplace, AI might “automate repetitive tasks and augment human capabilities …. [to] enable employees to focus on more complex and creatives aspects of their work.” Enhance cyber security as algorithms are created to identify emerging threats. Improve communication across language barriers.

In the last answer, there was no mention of the risk to employees as machines do more or the risk to all of us as criminals use AI to create cyber security threats. This shows how AI like Chat GPT can put a positive spin on things!

AI has helped drive this stock rally for approximately the last two months. In an Investment Committee Meeting about a month ago, we asked ourselves if we should update portfolios, as suitable, to include a specific AI position. We came to two conclusions:

- AI is strongly folded into portfolios, as suitable, today. We can see that through listing the top AI stocks (list from Chat GPT): Alphabet (Google), Microsoft, Amazon, IBM, Meta (Facebook), Apple, NVIDIA, Intel.

- We believed that AI stocks were overbought – too richly priced – and we believe that today.

When you next meet with your wealth manager, consider asking them which of your holdings contain AI stocks.

Stock market rally – outlook

Where does the stock market rally go from here? We’d like to see it broaden into other stock categories, the value/dividend-paying stocks, and the small/midsized stocks. We believe there is potential to do so as the Federal Reserve and other central banks ultimately come to the end of the rate-hiking cycle. Per JP Morgan, after the last six times the FED stopped increasing interest rates, stocks rose 10% to 35% over the following 12 months, with the only exception being the 2000 tech bust where negative forces overtook the positive2.

Slowing interest rate hikes should also help many types of bonds as this will steady bond principal values and allow new bonds to be invested at higher interest rates.

Portfolio updates

In 2023, as suitable, we’ve pared back dividend-paying/value stocks in favor of growth (tech/AI, etc.), lengthened bond maturities to seek less defense and higher yields, and reduced our international stock underweight as the dollar has tended to level off.

As you might expect, we will continue to monitor the global investment markets on your behalf and update your portfolio as we see what we consider to be valuable trends. As always, please let us know comments and questions.

References

- JP Morgan Weekly Market Letter, July 3, 2023.

- JP Morgan Markets at a Glance, March 2023.

Index Definitions

Bloomberg U.S. Aggregate Bond Market Index: A representation of SEC-registered, taxable, and dollar denominated securities. The index covers the U.S. investment grade fixed rate bond market, with index components for asset-backed securities, government and corporate securities, and mortgage pass-through securities. Must be rated investment grade (Baa3/BBB- or higher) by at least two of the following rating agencies: Moody’s, S&P, Fitch; regardless of call features have at least one year to final maturity and have an outstanding par value amount of at least $250 million.

S&P 500 Composite: Representing approximately 80% of the investable U.S. equity market, the S&P 500 measures changes in stock market conditions based on the average performance of 500 widely held common stocks. It is a market-weighted index calculated on a total return basis with dividend reinvested.

Russell 2000 Index: The index measures the performance of the small-cap segment of the US equity universe. It is a subset of the Russell 3000 and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

MSCI EAFE (Europe, Australasia, Far East) Index: A free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of June 2, 2014, the index consists of 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

MSCI Emerging Markets (EM) Index: A free-floating index offered by Morgan Stanley that captures mid and large capitalization stocks across more 26 countries including many in S. America, Eastern Europe, Africa, the Middle East, and parts of Asia, including Indonesia, the Philippines, and Taiwan.

Laura, the founder of LWP, is a Senior Wealth Manager, Chief Investment Officer and Shareholder. She has a master’s degree in tax and is an excellent listener. While she is a sophisticated financial planner with experience in complex issues, her priority is ensuring a financial plan works for people.