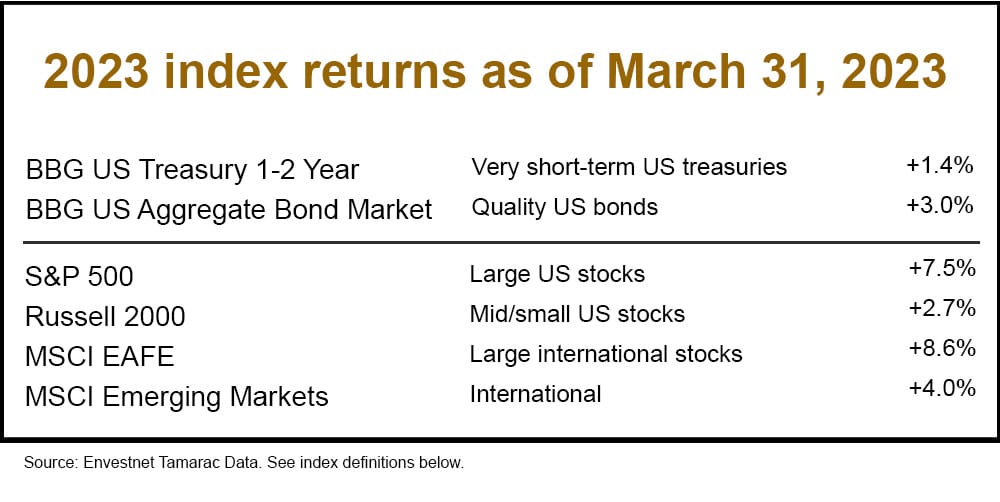

After a bear market last year, 2023 is looking up. See year-to-date results for some investment indices below. If you are a client, you can check your real time results in your LWP portal or your quarterly reports (winging their way to you this week).

The big question for investors is, “Will this upswing continue?” The very good news is that, barring surprises, the stage may be set for strong bond and stock investments returns over the next two to three years.

- Bonds took the big hit in terms of price last year. This is unlikely to recur. Bond interest rates are now higher, which bodes well. In addition, the Federal Reserve Board (FED) may decrease interest rates in 2024 or 2025, which would help bond values as well.

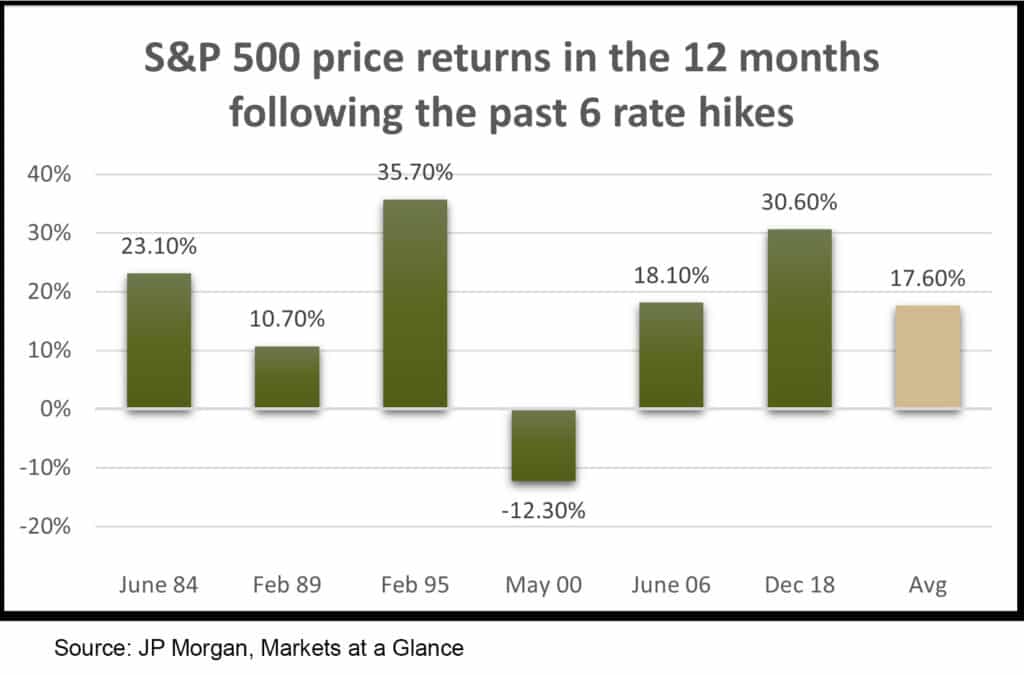

- Stocks also took a big hit in price last year, and additional volatility may occur before a sustained upswing. But historical data indicates that the stock market tends to do well after interest rate tightening cycles, often increasing 11% to 36% (see graphic below).

Tax Changes Ahead!

In client meetings, we are often talking about the expected 2026 income and estate tax changes that will increase both federal income tax rates and itemized deductions and will decrease the federal estate protected amount.

These changes offer cause to think about timing for charitable giving, home mortgage and property taxes, income recognition, and estate tax reduction strategies such as gifting. If you are a client, rest assured that we are taking these opportunities into account, as suitable, in our work for you.

As always, please let us know your questions and comments. We always appreciate hearing from you.

Index definitions

Bloomberg U.S. Aggregate Bond Market Index: A representation of SEC-registered, taxable, and dollar denominated securities. The index covers the U.S. investment grade fixed rate bond market, with index components for asset-backed securities, government and corporate securities, and mortgage pass-through securities. Must be rated investment grade (Baa3/BBB- or higher) by at least two of the following rating agencies: Moody’s, S&P, Fitch; regardless of call features have at least one year to final maturity and have an outstanding par value amount of at least $250 million.

Bloomberg US Treasury 1-3Y Index: A benchmark for high-quality, short-term bonds and measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with 1-2.999 years to maturity.

S&P 500 Composite: Representing approximately 80% of the investable U.S. equity market, the S&P 500 measures changes in stock market conditions based on the average performance of 500 widely held common stocks. It is a market-weighted index calculated on a total return basis with dividend reinvested.

Russell 2000 Index: The index measures the performance of the small-cap segment of the US equity universe. It is a subset of the Russell 3000 and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

MSCI EAFE (Europe, Australasia, Far East) Index: A free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of June 2, 2014, the index consists of 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

MSCI Emerging Markets (EM) Index: A free-floating index offered by Morgan Stanley that captures mid and large capitalization stocks across more 26 countries including many in S. America, Eastern Europe, Africa, the Middle East, and parts of Asia, including Indonesia, the Philippines, and Taiwan.

Laura, the founder of LWP, is a Senior Wealth Manager, Chief Investment Officer and Shareholder. She has a master’s degree in tax and is an excellent listener. While she is a sophisticated financial planner with experience in complex issues, her priority is ensuring a financial plan works for people.