Thursday, January 8th, 2026

By Laura Kuntz, CPA/PFS, MBT, Chief Investment Officer

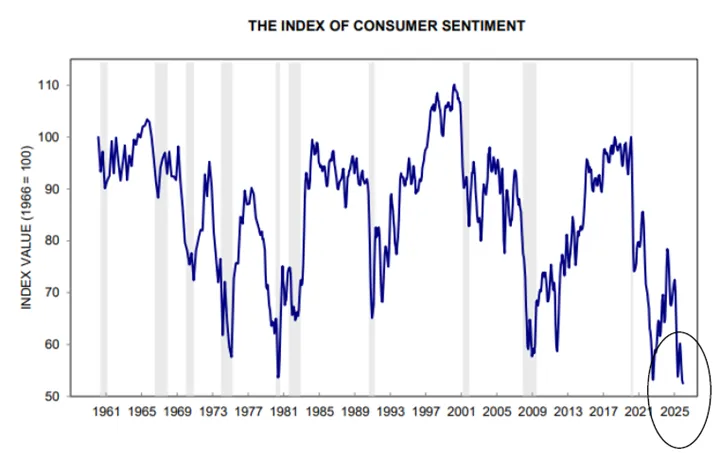

Some clients have asked why many investments have ended 2025 with nice gains while the clients themselves have been concerned about disruption and risk. If you are concerned, you are not alone. Your feelings are mirrored in national consumer sentiment data which moved near 50-year lows in 2025 (as measured by the commonly-used consumer sentiment indices offered through the University of Michigan).

Per this data, negative sentiment is widespread. My sense, though, is that folks feel negative for different reasons.

Investors: while the U.S. stock market ended the year on a positive note, up 18% on the S&P 500, the year was volatile due to tariffs and pressure on the U.S. relationships with other countries. From peak to trough, the S&P 500 fell almost -20% in early 2025. Some clients tell me that they are waiting for the next shoe to drop.

Consumers: Consumer sentiment often drops during times of economic stress, and inflation is a continuing issue. The U.S. entered 2025 with many analysts expecting inflation to fall to the Federal Reserve’s goal of 2% but, due to tariffs, has ended 2025 at approximately 3%. Inflation is more painful for folks with moderate to lower financial resources than it is for people with economic cushion who can better withstand the price increases. A family member recently said to me, “It seems like every time I go to the grocery store, things are more expensive.” To get a sense of the difference in the impact of inflation on different folks, consider that 70% of the wealth gains in the U.S. since 2019 have gone to the top 20%.*

Employees: AI is getting a lot of air time as a “taker of jobs,” and there have been some layoffs attributed to it. I certainly think that gets white-collar employees wondering and, perhaps, worrying. Unemployment rose during 2025, and now sits at approximately 4.5%, not a high rate, but also not moving in the right direction for employees who feel their jobs may be impacted.

With these negatives, why did 2025 produce positive investment results?

Most important is the flip side of AI, i.e., its potential to increase effectiveness in so many areas. Almost all of us are using AI today: GPS, Siri, google AI, Chat GPT. Interestingly, AI has now widened to increase corporate earnings among user firms, not just among creator firms. We at LWP use AI, carefully, of course. I’m not yet bowled over by it, but it can be helpful. And, I would say that it is showing promise for the future (and several challenges as well).

Second are the interest rate decreases implemented by the Federal Reserve Board, helping foster attractive returns in many types of bonds in 2025. The U.S. Aggregate bond index returned 7.2%, a good year.

Third is that foreign investing shone in 2025, posting 32% for international stocks (MSCI EAFE) and 8% for world bonds (Bloomberg Global Aggregate). In part, a falling U.S. dollar spurred this because that tends to enhance the value of foreign investments in the hands of U.S. investors. In addition, we saw big fiscal stimulus in Europe to rebuild their defense and technological achievements in AI and electric vehicles out of Asia.

LWP 2026 Outlook

2026 is likely to shape up as a battle between already overvalued U.S. growth/tech stocks (which may be a bubble) and falling interest rates which juice the economy. Other factors:

If the Supreme Court finds that the emergency tariffs are not legal, tariffs are likely to come down, though not be eliminated because the executive branch has a variety of other tariffing powers. A drop in tariff rates could cool inflation. This would be positive for the economy.

Falling U.S. interest rates may continue to create opportunity in international stocks and bonds. Here’s how that opportunity is created: U.S. interest rates decline, foreign money leaves for greener pastures, the dollar declines, and foreign investments rise in the hands of U.S. investors.

Alternative investments, i.e., positions that are neither a stock nor a bond, continue to have an important place in portfolios as both a diversifier and in potentially adding to returns. Bond alternatives, which we’ve used as suitable, have certainly added value in 2025 and we are excited about their potential for 2026.

As we here at LWP consider these multiple dimensions, we continue to recommend a neutral weighting for stocks (as suitable). You may recall that we often overweight stocks against your target because historically stocks have been up two days out of three and are, therefore, a good bet. But, given the risks which come with overvaluation and disruption – as well as considering the positives — we believe that a neutral weighting is currently wise. Of course, you likely know that we stand ready to buy stocks at attractive prices if volatility ensues.

Tax planning continues to offer value.

Potential strategies include identifying lower-tax years, Roth conversions, capital gain and loss recognition, tax free bonds, strategic IRA distributions, and positioning growth investments in tax-advantaged environments such as 529’s, Roth IRA’s, charitable accounts, and regular investment accounts. My partner, Mallory Kretman, CFP, Wealth Manager, leads us in a monthly meeting on new tax and financial planning strategies.

While we might hope for a peaceful, meaningful, and prosperous 2026, the year is starting with more disruption, with the U.S. taking action in Venezuela. While I so feel for the people of Venezuela and hope that the U.S. will be a help to them, I think the story in the financial markets will be told by other factors, especially AI and interest rates. Our personal financial stories will be influenced by how well we steward our assets, including diversification, savings, and cash flow & tax management. In terms of our personal financial success, I suspect that a calm, balanced. values-driven approach will continue to win the day. This is a good moment to remind ourselves of the Rudyard Kipling’s first line of the poem, If. “If you can keep your head when all about you are losing theirs …. yours is the earth and everything in it, and – which is more – you’ll be a man, my son.”

As ever, please let us know your questions and comments. I always appreciate hearing from you.

Investment returns from Envestment Tamarac.

*JP Morgan, “A Guide to the Markets,” 4th quarter 2025.

INDEX DEFINITIONS

S&P 500 index: this is an index of the 500 largest stocks in the U.S. It is subject to substantial price fluctuation.

MSCI EAFE index: composed of large- and mid-capitalization developed market equities, excluding the U.S. and Canada. It includes a broad range of companies in Europe, Australia, Asia, and the Far East. International stocks are subject to company, currency, and price risks.

Bloomberg Global Aggregate Bond Index: tracks the broad, investment-grade global bond market, measuring performance of government, government-related, corporate, and securitized bonds from developed and emerging markets in multiple currencies. Bonds are subject to both interest rate and quality risks and international bonds are subject to currency risk.

Bloomberg Aggregate Bond Index: tracks US investment grade bonds. Bonds are subject to interest rate and quality risks.

IMPORTANT NOTICE AND DISCLOSURE

The foregoing content reflects the opinions of Laurel Wealth Planning LLC and is subject to change at any time without notice. Content provided herein has been obtained from sources considered reliable, but we do not guarantee the accuracy, or the completeness of any description of securities, markets, or developments mentioned. The content is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. LWP is a wealth management firm and does not practice law or accountancy.

Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful.

As a precautionary measure, we cannot rely on e-mail requests to authorize, direct, or affect the purchase or sale of any security, wire transfer, or to affect any other transactions. Such requests, orders, or other instructions sent via email should be confirmed verbally, or by written instructions faxed to 952-854-6250 prior to their anticipated execution. We are unable to ensure that email sent to you from us, or sent from you to us, will be received. Please contact us at 952-854-6250 if there is any change in your financial situation, needs, goals, or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions. Additionally, we recommend that you compare any account reports from Laurel Wealth Planning LLC with the account statements from your custodian. Please notify us if you do not receive statements from your custodian on at least a quarterly basis. Our current disclosure brochures, From ADV Part 2 and Form ADV Part 3, are available upon request and on our website, www.laurelwealthplanning.com. This disclosure brochure, or a summary of material changes made, is also provided to our clients on an annual basis.